Lucas Jackson/Reuters

- The advance/decline line of the S&P 500, a widely followed technical analysis indicator that measures market breadth, just hit all-time highs.

- The record high in the advance/decline line is bullish for stocks and suggests that there is more upside ahead for the S&P 500.

- The surge in the advance/decline line “supports our bullish market outlook,” Fundstrat’s Robert Sluymer said in a note on Tuesday.

- Visit Business Insider’s homepage for more stories.

A technical indicator that measures internal market strength just flashed a bullish signal, suggesting more upside ahead for stocks.

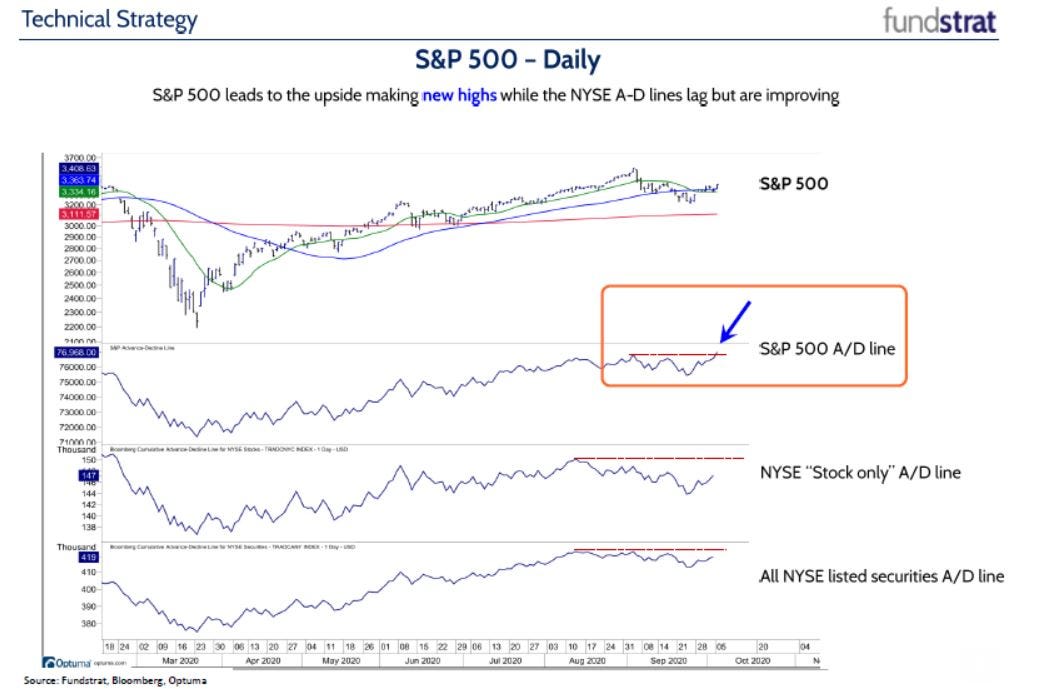

The advance/decline line of the S&P 500 index hit all-time highs on Monday, setting up a positive divergence between a rising A/D line and the S&P 500 trading below its September 2 high.

The A/D line measures the breadth of the market, or how many stocks of a given index are participating in an upside move. A rising A/D line means more stocks are moving higher than moving lower.

The A/D line is calculated by taking the difference between the number of stocks that closed higher in the previous day and the number of stocks that closed lower in the previous day.

A rising market and a falling A/D line suggests just a few mega-cap names are driving the market higher, while a rising market and a rising A/D line suggests more participation among stocks in the index, potentially pointing to a more sustainable rally.

Technical analysts use the A/D line to measure market sentiment and breadth, and to confirm breakouts or breakdowns in stock indices.

Fundstrat head of technical strategy Robert Slyumer said in a note on Tuesday that the breakout in the A/D line "supports our bullish market outlook," adding that "an expanding list of stocks are showing early evidence of bottoming intermediate-term after pulling back or consolidating."

While the A/D line of the S&P 500 has hit new highs, the A/D lines of the NYSE composite have not, so stocks aren't out of the woods just yet. The NYSE composite includes a broader swath of stocks including small caps, so it makes sense that it's lagging the A/D line of the S&P 500 given that large-cap stocks have been leading the rally.

But Fundstrat managing partner Tom Lee is staying bullish. Lee said in a note on Tuesday, "Whenever stocks A/D line makes a new high, the rule of thumb is that the index all time highs soon follow. It sure feels like stocks made their pre-election bottom...risk-on."